Unless you pay for everything via monthly direct debit, the chances are you have some large one off annual payments to make; be it home insurance, car insurance, car tax, the TV license or maybe paying the balance of your summer holiday. We have all of those and others like swimming lessons (3 times a year), drumming lessons for our eldest (again, 3 times a year) and even stuff like domain renewals and hosting costs.

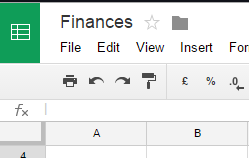

In the previous two posts in this series we’ve looked at how to prepare a cashbook in Google Docs and how to perform some analysis on the figures. However, even if you’ve laboriously sat down and compiled a full six months of bank statements, the chances are you’ve not captured all of the annual payments you make.

What’s the best way to work out what sort of number you’re dealing with? Firstly start of with a brainstorming session- write down everything that you can think of that you’ve either already captured in your cashbook or you know you spend semi regularly. Our list looks like this:

- Summer holiday

- Car insurance

- Home and contents insurance

- Swimming lessons

- Drumming lessons

- Website hosting and domain name fees

- Professional subscriptions

Yours will of course look pretty different unless you’re me, stumbling on this post several years down the line, in which case, pay more attention Alex! The next stage involves a calendar, or to be more precise a year planner. The first thing you should do is write the type of irregular expense and the amount on the calendar in the month it occurs. This will give you an idea of whether there are any pinch points- for example does your house insurance coincide with the time you usually pay the balance on your summer holiday? Normally house and contents insurance is determined almost by default- it’s the day you move in to your current place- but you can alter the terms of the policy if necessary, to alter the period it runs from and to.

The next part depends a little on how much you’ve managed to do in terms of making a cashbook. What we need to do now is look at our “net position” at the end of every month in our cashbook and adjust it for any items that are semi regular. By “net position” I mean income less total expense- basically what you’re left with at the end of that particular month. By taking out any of these semi regular payments, we’re ensuring we don’t double count anything. For any month in your analysis that you have a net position for, put this on the calendar too. Obviously the more months you have, the better but the ultimate aim is to see if their are particular months in the year where “normal” expenditure is lower. It might be, for example that July is a cheap month- you’ve bought all your summer clothes back in June, the heating is off and saving you a fortune and you’re feasting on salads so you have the perfect beach body.

Knowing which months are cheap months is helpful because the traditional way of accounting for and ultimately saving up for annual expenses is to put a little aside every month to cover the amounts. This can run into problems though when you hit an expensive month like December (Christmas) or August (summer holidays), so it might be better to plan individually for each expense. For example, I know that we pay our council tax in ten monthly instalments, so we have two months (Feb & March) where we don’t give the council £209 a month to fail to run the local services properly. I put this money aside to pay for my professional subscriptions as an accountant. I could put £30 a month away instead but for me, it makes sense to do it in two bigger chunks when I know the money is available.

Since a cashbook is just that, a book detailing movements in cash, you can’t put any transactions in it that aren’t cash based. If you do that, you’re moving from cash based accounting to accruals based accounting and that’s a lot more complicated and really beyond the remit of what I’m writing about. What you can do however is use the newly prepared analysis of semi regular expenditure you have, coupled with the rough idea of how you are going to save for these expenses, to make regular contributions to a savings account that you can use to fund the expense. But I’m stepping into the realm of basic cashflow management here, which is really the subject of my penultimate and next post.